I have seen profit margins vanish overnight because of sudden price spikes or factory delays. It is a nightmare for any business owner. But you do not have to lose money when costs rise.

I manage cost risks by locking in exchange rates and raw material prices within contracts before production starts. I also implement tiered Quality Control inspections to prevent expensive rework and maintain a warm backup supplier to leverage negotiation power against sudden hikes.

Let’s break down exactly how I protect my clients’ bottom line when manufacturing overseas.

How Do I Monitor Factory Cost Changes in Real Time?

You send an order, then silence. Suddenly, the factory demands more money for materials. I hate that surprise. Here is how I stop it before it happens.

I require open-book cost breakdowns and link unit costs to public commodity indices in the manufacturing agreement. This ensures any price increase is based on verified market data, not arbitrary demands, allowing me to track fluctuations before they impact the invoice.

To truly control costs, you have to look deeper than the final price tag. Many buyers just accept the quote the factory gives them. I do not. I perform a rigorous “Should-Cost” analysis. This means I take the product apart, physically or digitally. I list every single material in the Bill of Materials (BOM). I calculate the cost of plastic, metal, and electronics based on current market rates. Then, I estimate the labor hours needed for assembly using local Chinese labor rates. This scientific approach reveals the true cost of the item. It helps me find hidden margins the supplier might be padding into the quote. When I show a China supplier that I know exactly what their costs are, the conversation changes. They know they cannot bluff me with fake price increases.

Another major factor is the relationship with the supplier. It is not just about numbers; it is about people. I keep regular contact with the factory management. I do not just ask “is the order ready?” I ask about their upstream suppliers and the raw material market. Often, suppliers have a buffer built into their profit margin. They do this to protect themselves if material prices go up. If I maintain a good relationship, I can negotiate for them to absorb small fluctuations using that buffer. We agree that prices will stay stable for a set period, like six months. This gives my client certainty. It also helps the factory because they get consistent orders. We create a partnership where information flows both ways. If they see copper prices rising, they tell me early. Then, I can warn my client. We are never caught off guard.

Do I Lock in Pricing Through Contracts or Deposits?

Handshakes do not protect profits. I used to trust verbal promises until costs jumped 20% mid-order. Now, I rely on strict written agreements to keep prices stable.

I secure pricing by defining validity periods in purchase orders and using penalty clauses for unilateral increases. I also negotiate capacity reservation agreements ahead of peak seasons to avoid rush fees, while using forward contracts to insulate margins from volatile currency exchange rates.

Contracts are your strongest shield against risk. When I draft a manufacturing agreement, I do not just look at the product specs. I look at the money. One of the biggest risks in international trade is currency fluctuation. The exchange rate between the RMB and the USD changes every day. If the RMB gets stronger, the factory gets less money for the same dollar amount. They might try to pass that loss to you. To stop this, I use forward contracts or specific clauses in the purchase agreement. We agree on a fixed exchange rate range. If the currency moves within that range, the price does not change. This insulates your profit margins. You know exactly what you will pay, regardless of what the stock market does.

Another critical time is the peak season, specifically before Chinese New Year. Factories get overwhelmed. They run out of capacity. When that happens, they charge extra for “rush orders” or expensive air freight to make up for lost time. I avoid this by negotiating capacity reservation agreements months in advance. We book the production lines early. The contract includes penalty clauses. If the factory delays our order because they took on too much other work, they pay a fine. This keeps them honest.

Payment terms also play a huge role in risk management. I never advise paying 100% upfront. That is gambling. Instead, I break payments into milestones. We pay a deposit to start. We pay a mid-production installment only after we see proof of progress. We pay the final balance only after a successful inspection. This structure keeps the leverage in our hands. If the quality drops or the price changes, we still hold the money. It forces the factory to stick to the deal. A China sourcing agent must structure these terms carefully to protect the client’s capital at every stage.

Can I Alert Clients to Currency or Material Price Shifts?

Your profit margin is thin. If the exchange rate moves, you lose money. I watch these numbers daily so you do not have to panic.

I monitor currency trends and material costs weekly, providing transparent reports to clients. By setting clear Incoterms like FOB, we define exactly who pays for logistics, preventing unexpected local charges from inflating the final landed cost when market shifts occur.

Communication is the difference between a minor adjustment and a major crisis. I act as the eyes and ears on the ground. I do not wait for the client to ask about prices. I track the trends myself. If I see that the cost of shipping containers is rising, I alert the client immediately. This allows us to make decisions fast. Maybe we ship early to beat the price hike. Maybe we consolidate orders. This proactive approach saves money.

We also have to talk about Design for Manufacturability (DFM). This happens before we even cut the tools. I review the design to see if we can simplify it. Can we use a standard component instead of a custom one? Standard parts are cheaper and their prices are more stable. Can we reduce the number of assembly steps? Fewer steps mean less labor and less chance for error. By optimizing the design, we reduce the risk of high scrap rates. If the factory produces a lot of defective units, they will eventually try to raise the price to cover their waste. DFM stops this at the source.

Defining Incoterms is another way I control costs. Terms like FOB (Free On Board) or EXW (Ex Works) dictate who pays for what. If the terms are vague, you might get hit with “local charges” for domestic transport or port fees in China. These can be surprisingly high. I define precise Incoterms in the contract. We state clearly where the factory’s responsibility ends and where ours begins. This prevents unexpected bills. We also do a full landed-cost calculation. This includes everything: materials, packaging, labor, tooling, logistics, tariffs, and my fee. I share this transparent breakdown with the buyer. There are no “hidden costs.” The client knows the exact price to get the product to their door. This transparency builds trust and helps us plan for any market shift.

What’s My Backup Plan if Prices Spike Mid-Project?

Reliance on one factory is dangerous. I learned this the hard way when a supplier doubled prices overnight. You need a safety net to survive.

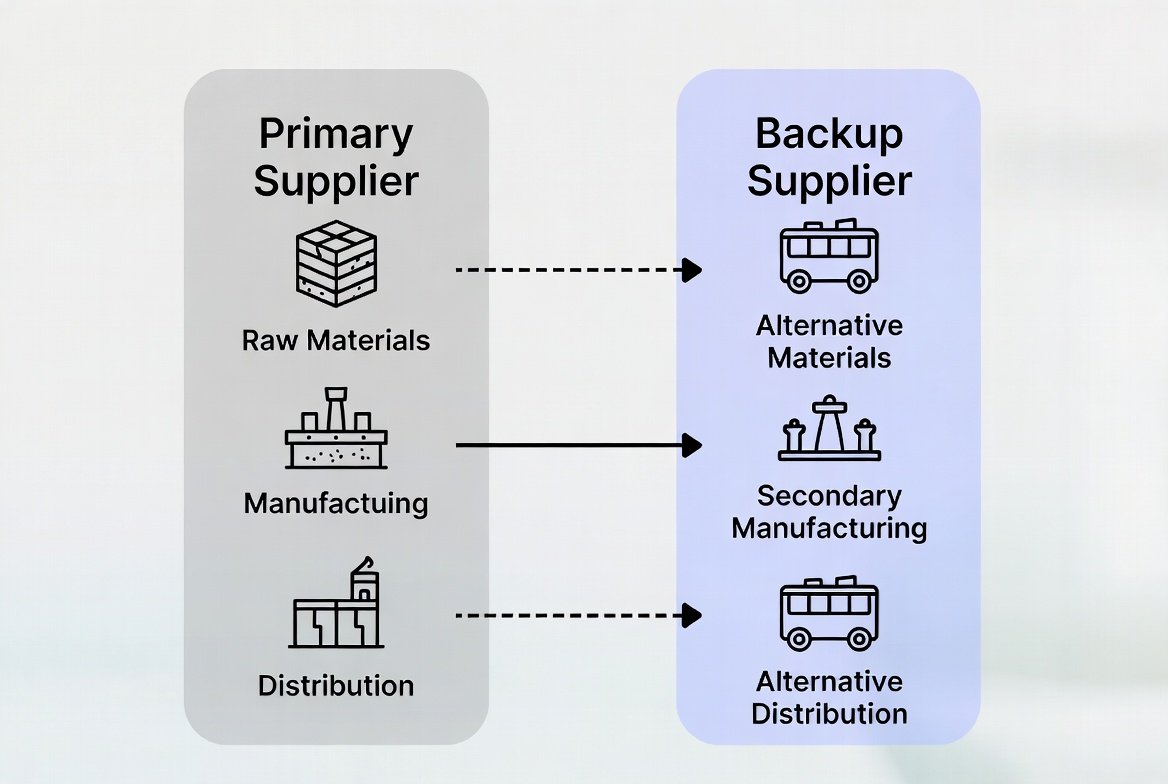

I always validate and maintain a “warm” backup manufacturer to prevent production stoppages. This diversity gives me leverage to reject sudden price increases. I also audit sub-tier suppliers to avoid forced labor risks that could lead to costly customs seizures.

Having a “warm” backup is my most important strategy. A “warm” backup is a supplier that we have already vetted. We have checked their samples. We have negotiated a price. We might even place small orders with them just to keep the account active. If our primary supplier suddenly raises prices or goes bankrupt, we are not stuck. We can switch production to the backup immediately. This gives us immense power in negotiations. If the primary supplier knows we have another option, they are much less likely to play games with the price. They know we can walk away.

Quality control is also a cost-saving tool. Many people think QC is just about checking the final product. But if you find a defect at the end, it is too late. The money is already spent. I use Quality control China sourcing methods that focus on prevention. We do Pre-Production checks to ensure the raw materials are correct. We do During Production checks to catch problems while the machines are running. If we catch a defect early, we can fix it before the whole batch is ruined. This avoids the high costs of post-production rework or scrapping the whole order.

Finally, we must look at the supply chain’s legal risks. Laws like the UFLPA (Uyghur Forced Labor Prevention Act) are strict. If a component in your product comes from a banned region, Customs will seize your shipment. You lose the goods and the money. I audit sub-tier suppliers to verify where every screw and circuit board comes from. We ensure the manufacturer has the financial solvency to complete orders without labor strikes. We mitigate the risk of supply chain accusations that can lead to shipment rejections. Managing cost is not just about the price on the invoice; it is about ensuring the goods actually arrive and can be sold.

Final Thoughts

Managing cost risks requires more than just hoping for the best. It takes strict contracts, deep market analysis, and a backup plan for every scenario. By controlling the process from the very start, we protect your margins.

Would you like me to audit your current supplier contract for hidden cost risks?